It contains information for employers on the employment tax treatment of fringe benefits including health savings accounts and qualified small employer health reimbursement arrangements.

Irs link and learn hsa.

This communication is not intended as legal or tax advice.

Health savings accounts hsas a health savings account hsa is a tax exempt trust or custodial account you set up with a qualified hsa trustee to pay or reimburse certain medical expenses you incur.

With an hsa you own the account and all contributions even if you change health plans retire or leave your employer.

Traditional and roth.

Health savings accounts and other tax favored health plans page 7.

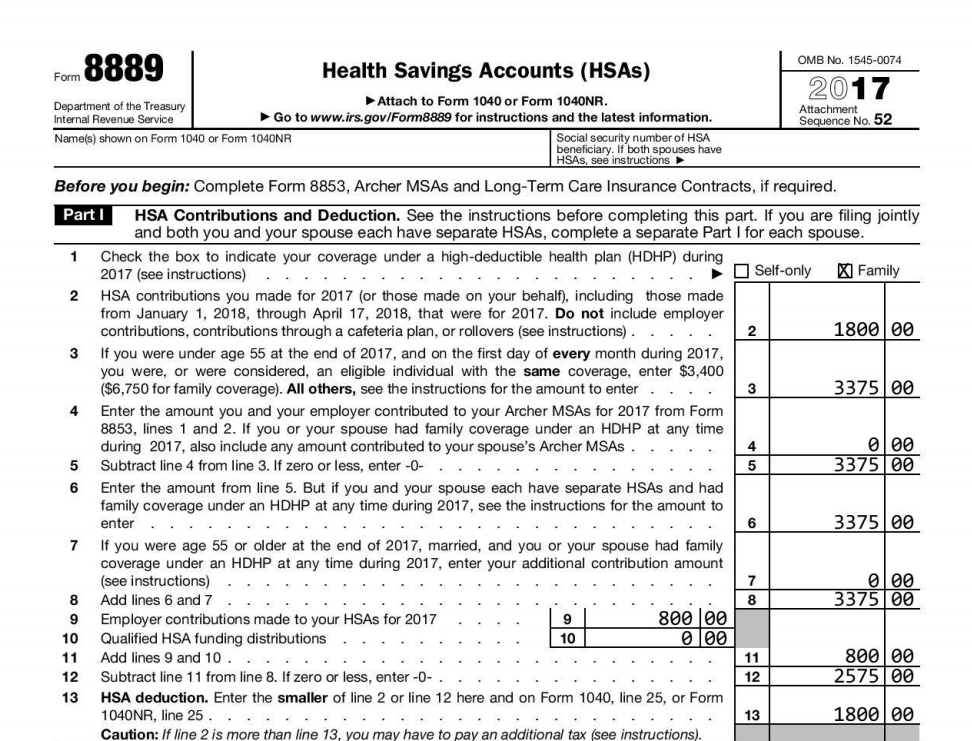

The trustee then shares that information to the account owner through irs form 1099 sa.

Forgot password or username.

Internal revenue service irs.

Internal revenue service irs.

It is included in publication 4942 health savings accounts hsas.

Hsa account holders are responsible for reporting their own distributions to the irs through tax form 8889.

Foreign tax credit workout.

This includes deductibles co insurance prescriptions dental and vision care and more.

No permission or authorization from the irs is necessary to establish an hsa.

This course is available online on link learn taxes or you can download and print a copy of the course by going to www irs gov.

You must be an eligible individual to qualify for an hsa.

Link learn taxes linking volunteers to quality e learning.

Test includes standards of conduct evaluation survey.

Unlike flexible spending accounts the entire hsa balance rolls over each year.

Welcome to the health savings accounts hsa course.

Accessed may 7 2020.

Health savings accounts hsas are individual accounts offered by optum bank sm member fdic and are subject to eligibility and restrictions including but not limited to restrictions on distributions for qualified medical expenses set forth in section 213 d of the internal revenue code.

In terms of reporting hsa tax information the hsa trustee or custodian keeps all reports of distributions.

Irs qualified medical expenses you can pay for a wide range of irs qualified medical expenses with your hsa including many that aren t typically covered by health insurance plans.

Money put into your hsa is not taxed and you earn tax free interest on hsa balances.

2019 25 irs gov this revenue procedure provides the 2020 inflation adjusted amounts for health savings accounts hsas.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)