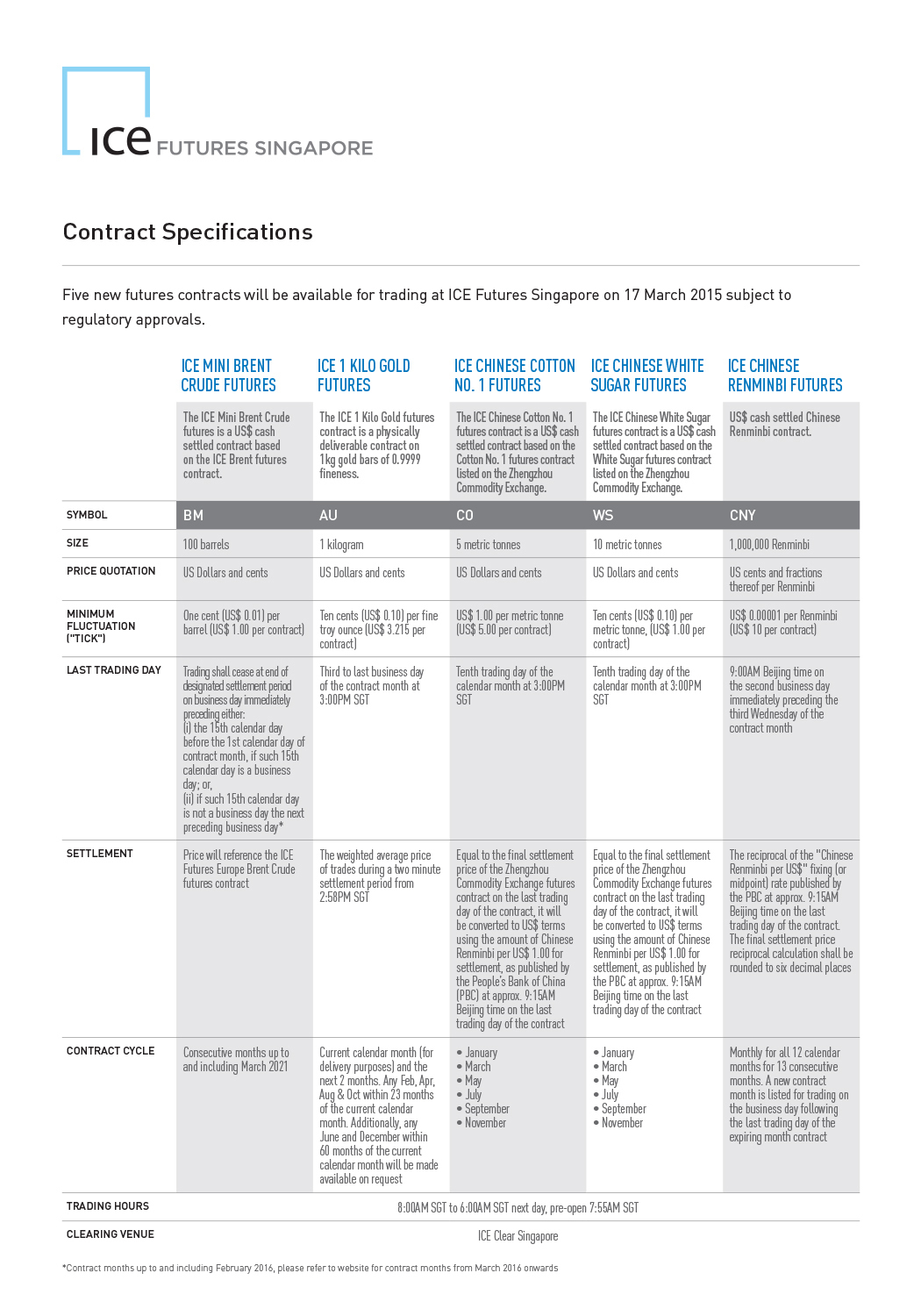

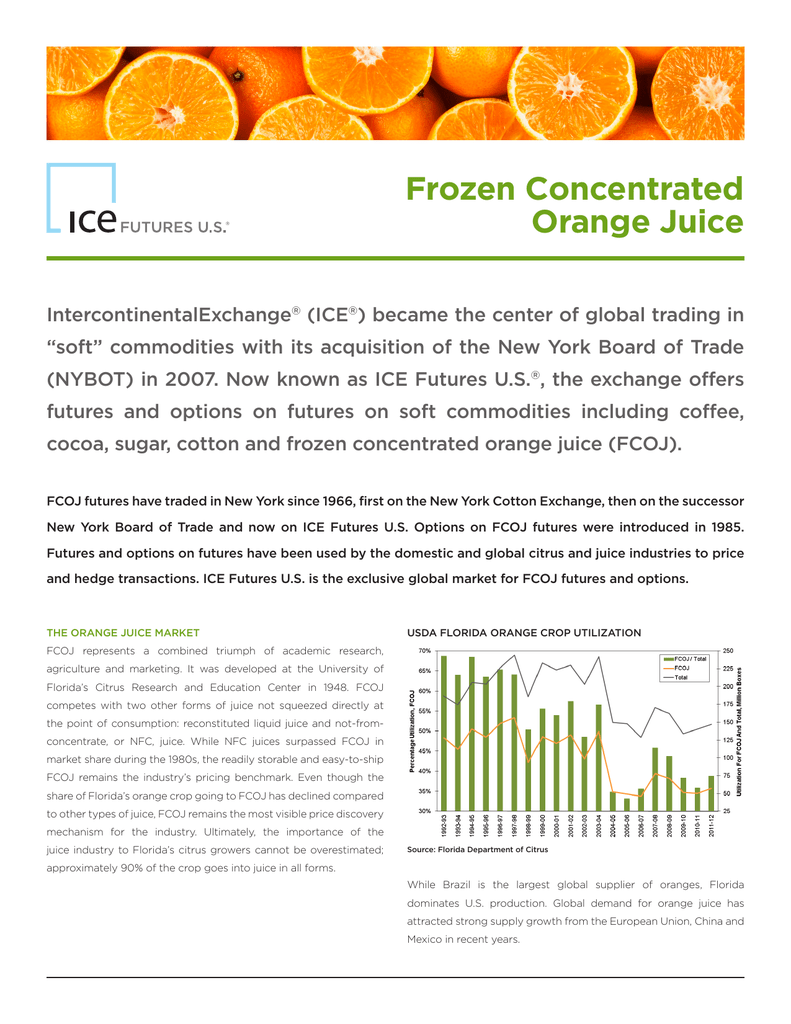

Qa verifies that all cotton submitted to commodity exchanges such as the intercontinental exchange ice meet futures contract specifications.

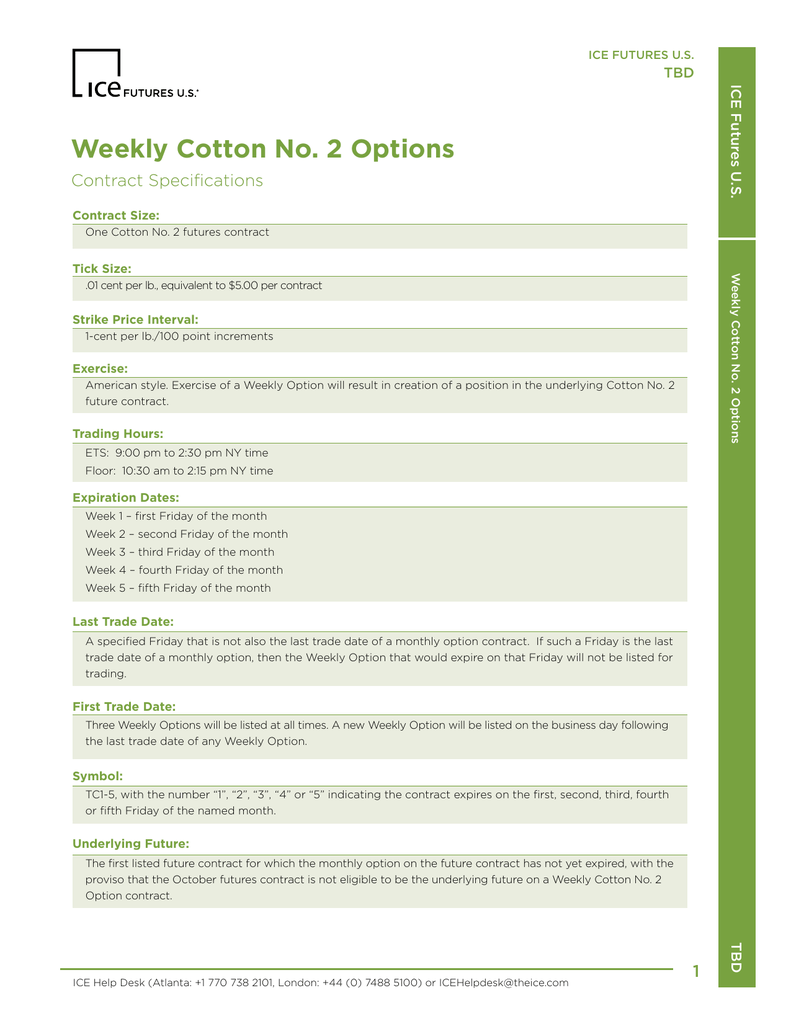

Ice cotton futures contract specifications.

All futures news.

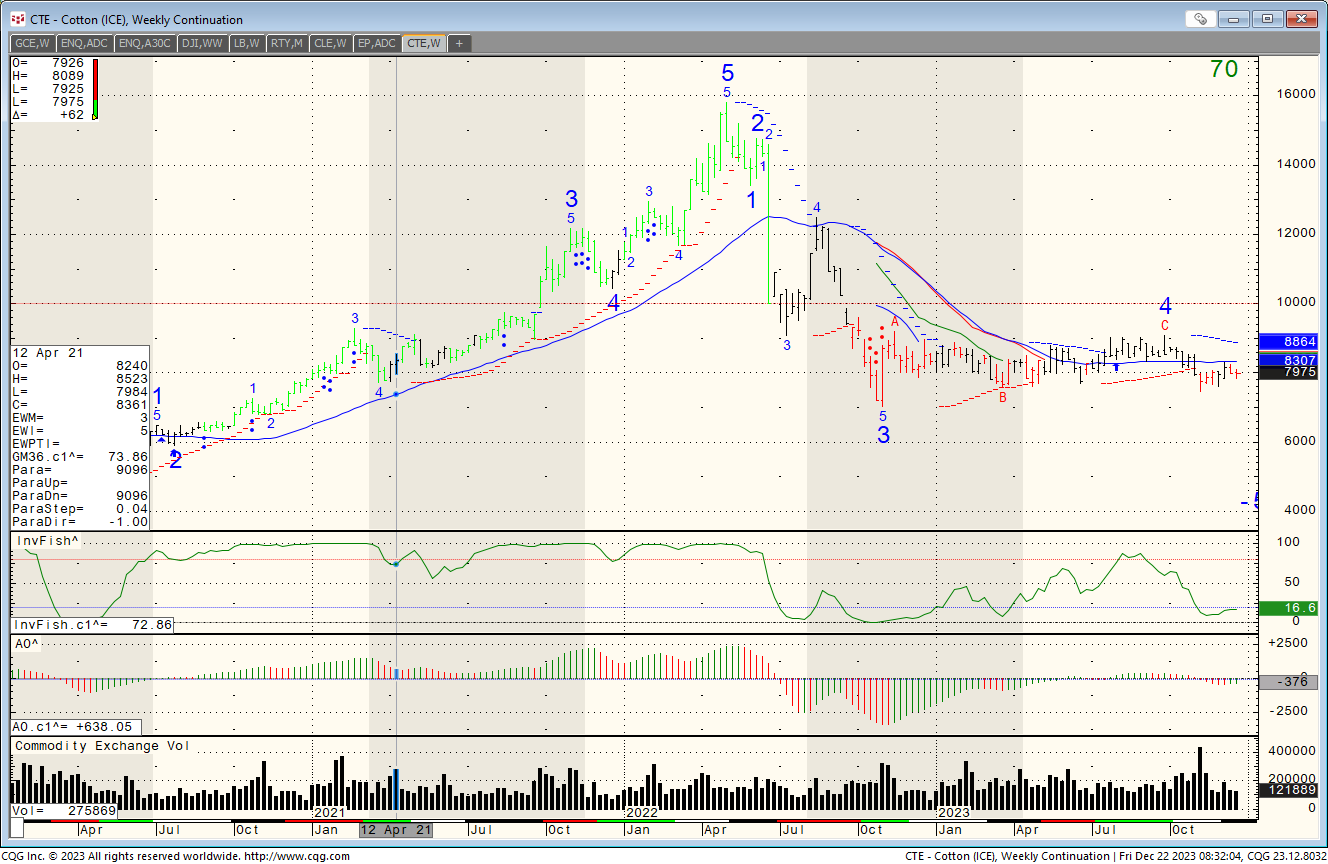

Cotton contracts usually expire in the months of march may july october and december.

On the ice and nymex a cotton contract is settled for 50 000 pounds of the commodity and can be traded on their electronic trading platforms.

15711 usda ams.

1 100 of a cent one.

178 usda ams.

Ica bremen is the international centre of excellence for cotton testing research quality training and certification.

Quality of cotton classed by state 2020 09 03 sep 4th 2020 09 07 da length.

Learn why traders use futures how to trade futures and what steps you should take to get started.

Services for interest rate equity index ag and global energy derivatives.

Cotton prices continue to increase thanks to the fact that out of all the fiber that is in use around the globe on a daily basis cotton accounts for over.

Delivery points include texas galveston and houston new orleans memphis and greenville spartanburg in south carolina.

Trade cotton 2 now with.

More features more insights get quick access to tools and premium content or customize a portfolio and set alerts to follow the market.

Ice clear europe energy.

Cotton futures trading is significantly impacted by the fact that the united states india and china are all responsible for the production of over 60 of the cotton used all over the world.

Daily market rates grain miscellaneous commodities 2020 09 08 sep 8th 2020 08 14 da length.

Us per pound.

2 cotton with a quality rating of strict low middling and a staple length of 1 and 2 32 inch.

188 usda ams.

The quality assurance division is an ica bremen certified laboratory.

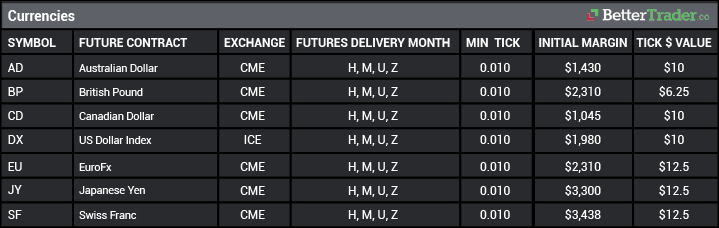

Agricultural metals currency credit and equity index futures and options contracts.

Daily cotton quality summary by state cndcqs s.

Established in 1915 as the new york cotton exchange association ice clear u s.

Capital efficient clearing services for european equity derivatives products.

Continues to build on more than a century of providing secure capital efficient counterparty risk management and post trade services for ice futures u s.

The new york cotton exchange s futures contract calls for the delivery of 50 000 pounds net weight approximately 100 bales of no.